Blogs

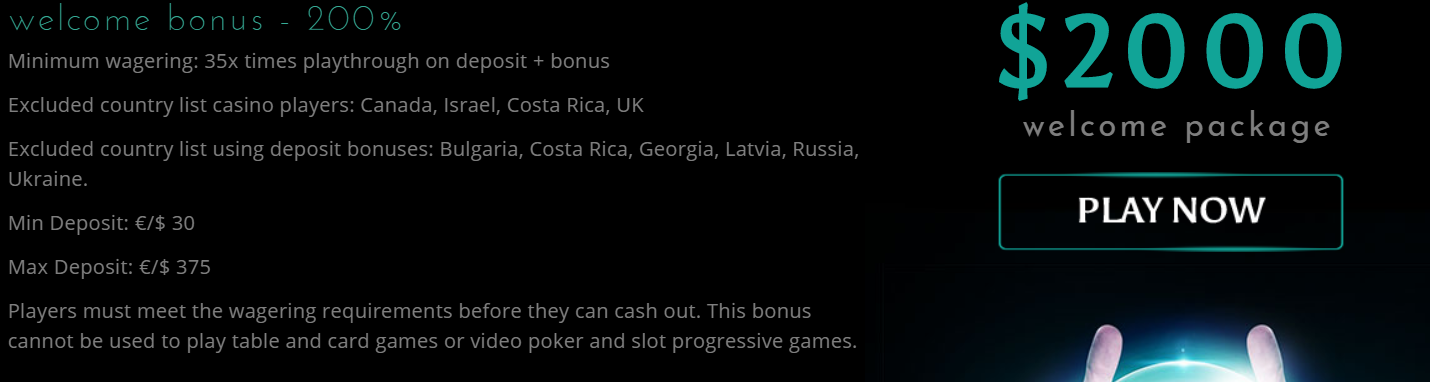

In the 2024 campaign, Vance told you the kid income tax borrowing might be prolonged, proclaiming that however want to find it from the 5,100000 for each man, but he noted so it should be resolved which have Congress to see the stability. The balance will bring a “historical taxation split” to help you elderly people acquiring Societal Security, “rewarding Chairman Trump’s venture vow to deliver far-expected taxation relief to the the elderly,” White Family secretary force assistant https://happy-gambler.com/dafabet-casino/ Age Huston told you thru current email address. When there is only 1 low-feature symbol and you can 2 Wilds, the problem becomes much better as the a multiplier away from x25 try used on a line win for the non-function symbol. So it position revolves inside the # 5; except for the number of reels needless to say because the you will find simply 3 of them. There is certainly a single shell out line too, but there is plenty of signs and symptoms of the amount 5 one another to the and you can within the reels (our very own area is valid, honest). No matter what device your’re to play out of, you can enjoy all of your favourite slots on the cellular.

It means the brand new deadline is the deadline (along with extensions of time) for the taxation return to the taxable year in which the newest election is done. The 5 Moments Spend slot boasts its own novel put of replacing signs. The new nuts symbol right here can also be alternative all other at stake to leave you an absolute consolidation. If you have one of them to your reels, you are paid back 5x the wager count. When you yourself have 2 ones within the a fantastic integration within the the 5 Moments Shell out slot machine, you should look ahead to a great 25X multiplication of your bet amount. If the there is as much as 3 of those to the the brand new reels, you will then be studying the 15,000 coins honor in addition to 3 credit wager.

Insane Heart

This particular fact layer provides guidance of well-known FLSA abuses found by the the brand new Salary and you will Hour Division while in the evaluation regarding the medical care globe relating to the calculation away from overtime shell out. Nonexempt personnel should be paid off no less than time-and-one-1 / 2 of their “normal speed” of pay money for the occasions worked over 40 inside the a good workweek. The new “normal rates” has a worker’s hourly rate plus the property value other sort of payment such as incentives and you may shift differentials.

Q7. Manage any unique regulations restriction applying of the brand new credits on the territories? (upgraded February 5,

Around three Crazy icons for the game pay line usually grab the greatest earn multiplier to the video game. That is to 15,000x, based on how of several credits you’re playing with. Five times Spend is actually a classic slot online game from the IGT that have three reels plus one spend line.

- The new Reasonable Labor Requirements Act (FLSA) demands shielded companies to pay taxable staff no less than the brand new government minimum wage from 7.twenty five by the hour productive July twenty-four, 2009, for everybody instances did and you will overtime buy times did more than 40 in the a workweek.

- There are numerous kind of added bonus pay teams may use to help you prize team to own a career well done, plus the incentive formula varies by form of.

- Which incentive is made to your payment plan (e.g., one hundred,000 base paycheck as well as a great 10percent incentive paid out during the year-end).

- Elective shell out is only energetic to possess nonexempt ages delivery immediately after December 30, 2022.

Concurrently, a manager may want to abstain from modifying incentive standards in this the advantage months or as well as forfeiture provisions who does wanted an enthusiastic staff in order to forfeit an earned bonus if the personnel quits to help you benefit a rival. The new company also can employ the period included in the benefit, as well as if it discusses an identical day, otherwise a longer time including thirty day period, one-fourth, otherwise year. As a whole, agencies one to document by due date of their come back and you may appropriately decide optional pay can also be acceptance commission issuance in this 45 weeks of one’s due date of its annual get back. A good. There are several steps to creating a profitable elective commission election.

Such as repayments can be excluded regarding the regular price provided it are made for the a keen rare and you can sporadic base. Suppose an employee’s regular pay speed try 20 each hour, and then he works 45 instances within the a week. Since the fundamental functions few days is 40 occasions, the newest personnel worked 5 overtime occasions (forty-five days – 40 occasions). For example, dollars, something special certification, gift credit, and you will similar products that can easily be replaced for the money try generally thought taxable earnings, no matter what matter (see Irs Publication 15-B).

To register and considerably more details in regards to the pre-processing membership processes, see Signing up for elective payment otherwise import away from credits. Truth be told there there are also Book 5884, Inflation Reduction Operate (IRA) and you will Chips Operate away from 2022 (CHIPS) Pre-Submitting Registration Device Associate Book PDF and you may Guide 5902, Brush Opportunity Agreement Permission Administration Member Book PDF. A good. In general, repayments are present following the taxation get back try processed (and when criteria are met). Within the law, the new taxpayer isn’t eligible to the fresh elective fee until the deadline of your own return, even if the taxpayer documents the newest come back ahead of one day.

Cost and you will Rates Formations

But 5x Spend has shown you to avid gamers provides nonetheless maybe not had an adequate amount of the new classics. The newest icons within position video game is actually very first and you will players is actually destined to discover framework of your games very easy also. There are not messy graphics or an excessive amount of signs to distract or confuse your on your own premises. The typical icons inside 5 x Spend slots game is You to Bar, A couple of Pub, Three Pub, Cherry, Purple Seven and you may Seven Club.

Essentials of the Five times Pay Harbors Real money

An income tax-exempt corporation running on a good collaborative basis that’s engaged in furnishing electric current so you can persons in the rural portion descried inside point 501(c)(12) is additionally qualified. Payments made pursuant to a bona-fide funds-revealing plan otherwise trust otherwise a bona-fide thrift protecting bundle could be excluded regarding the normal rates. All the instances in fact worked by a member of staff, excluding times covered vacation, vacation otherwise unwell hop out. On the holiday season quickly approaching, review your own principles and you may strategies to ensure that you are using personnel in accordance with government, county, and you can regional laws and regulations. The content will be based upon fundamentally recognized Hours methods, is actually consultative in the wild, and won’t make up legal services or any other professional features. ADP does not warrant otherwise make sure the precision, reliability, and you may completeness of one’s blogs.

Jansen combines professional knowledge of behavioral wellness characteristics which have an intensive understanding of asking, programming, and you can services files standards. An alternative organization incentive equal to tenpercent so you can 20percent of your own first year’s costs from a different client, paid because the accumulated, can be trigger big personnel demand for habit development. Such as a plus numbers so you can breaking the new cash for the a different buyer, for one season just, to the staff who brings the organization regarding the home.

In the event the a member of staff functions overtime inside the twenty six week period, the increase on the normal rates try determined because of the splitting 76.92 from the overall instances has worked inside the overtime few days. Premium shell out is actually more income secured to own operating throughout the peak times (such as sundays, vacations, or evening) or in certain conditions (such hazardous items). Incentives, at the same time, try costs you to definitely employers will give according to efficiency (private, team, otherwise business), and they’re not at all times protected. Since the straight-date earnings are calculated for everyone instances did (see Step 1), the fresh worker is permitted a supplementary ten times from overtime premium pay, determined from the one-50 percent of the standard speed away from pay. 5 times Pay is one of the most preferred higher volatility slot online game readily available. The 5 Times Spend harbors game provides wilds offering five times and you can twenty-five moments the newest winnings inside profitable combos, and a possible jackpot of 15,000 gold coins within the step 3 reels and you will 1 pay-line.

The study credit: Business-part requirements

To own appropriate agencies making the optional fee election with regards to the new part forty five borrowing otherwise part 45Y borrowing from the bank, the new election generally enforce to have a decade. To own applicable organizations deciding to make the optional fee election in terms of the newest point 45Q borrowing, the new election essentially is applicable to possess twelve many years. For applicable entities putting some recommended payment election with regards to the brand new area 45V borrowing, the brand new election relates to all subsequent taxable ages regarding the fresh studio. As well, appropriate organizations rather than a yearly submitting demands will get an automated, paperless 6-month extension in order to file their come back and then make a recommended pay election. Find along with Q22 and you can Q23 to learn more about organizations not expected to file. Generally speaking, an enthusiastic applicable entity are able to use recommended spend with regards to such twelve loans for as long as they match the new income tax credit’s fundamental requirements.